Technical Analysis & Forecast 07.05.2024

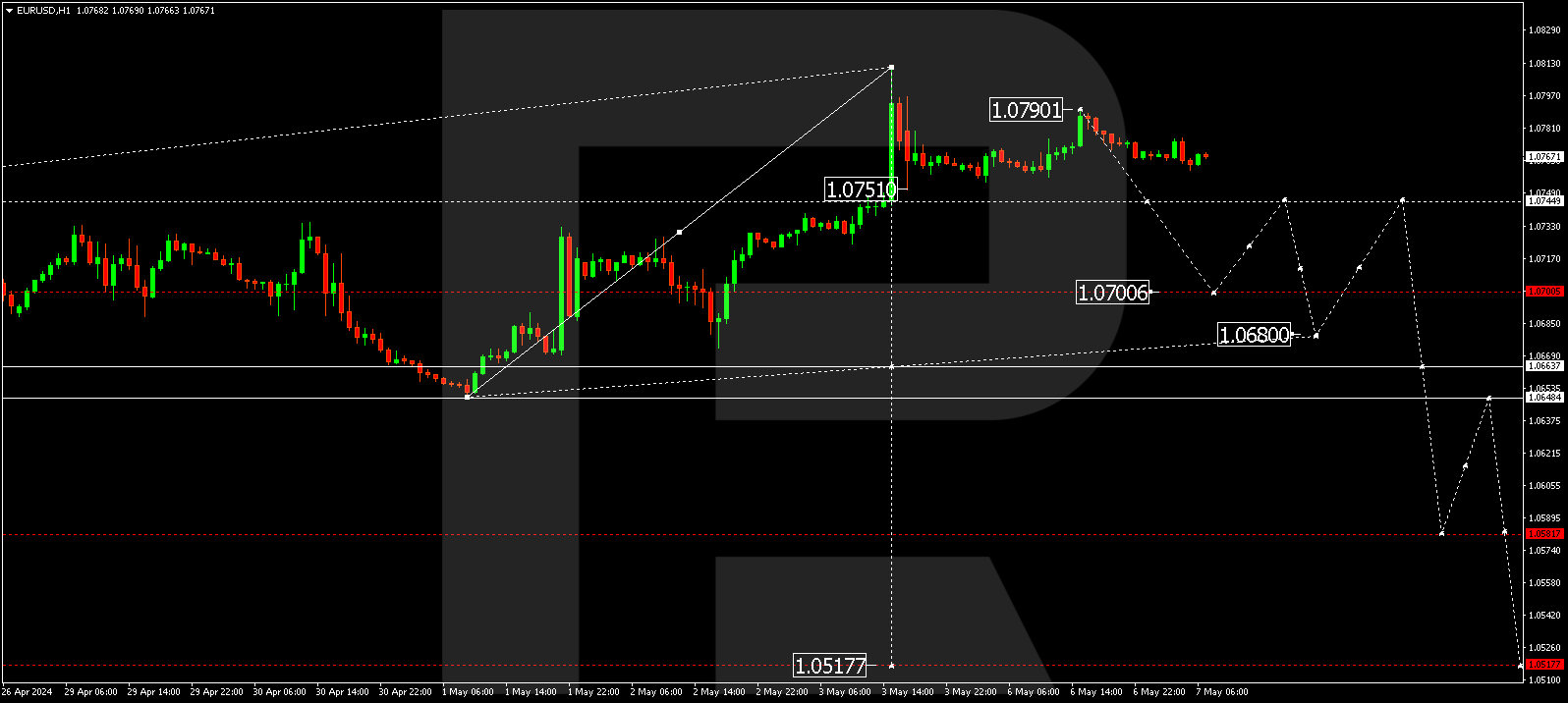

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a downward impulse, reaching 1.0751. The market has corrected to 1.0790 today and is currently developing another decline structure aiming for the local target of 1.0700. After the price reaches this level, a corrective phase is not ruled out, targeting 1.0744. Subsequently, the price could decline to 1.0680, with the trend potentially continuing to 1.0580.

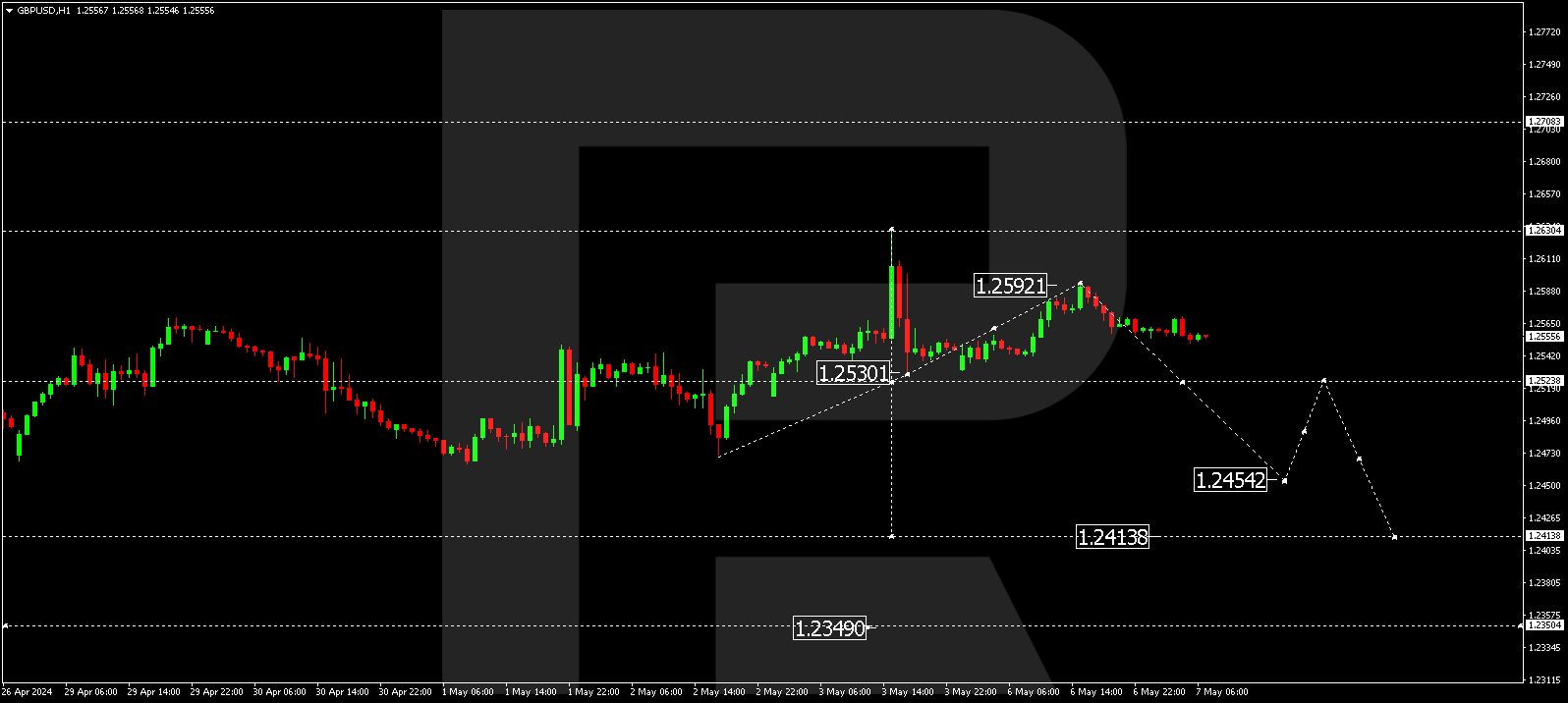

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a downward impulse, reaching 1.2530. The market has corrected to 1.2592 today and is currently developing another decline wave aiming for 1.2454. After the price hits this level, a corrective phase is not ruled out, targeting 1.2524. Subsequently, the price could fall to 1.2414, from where the trend might continue to 1.2350.

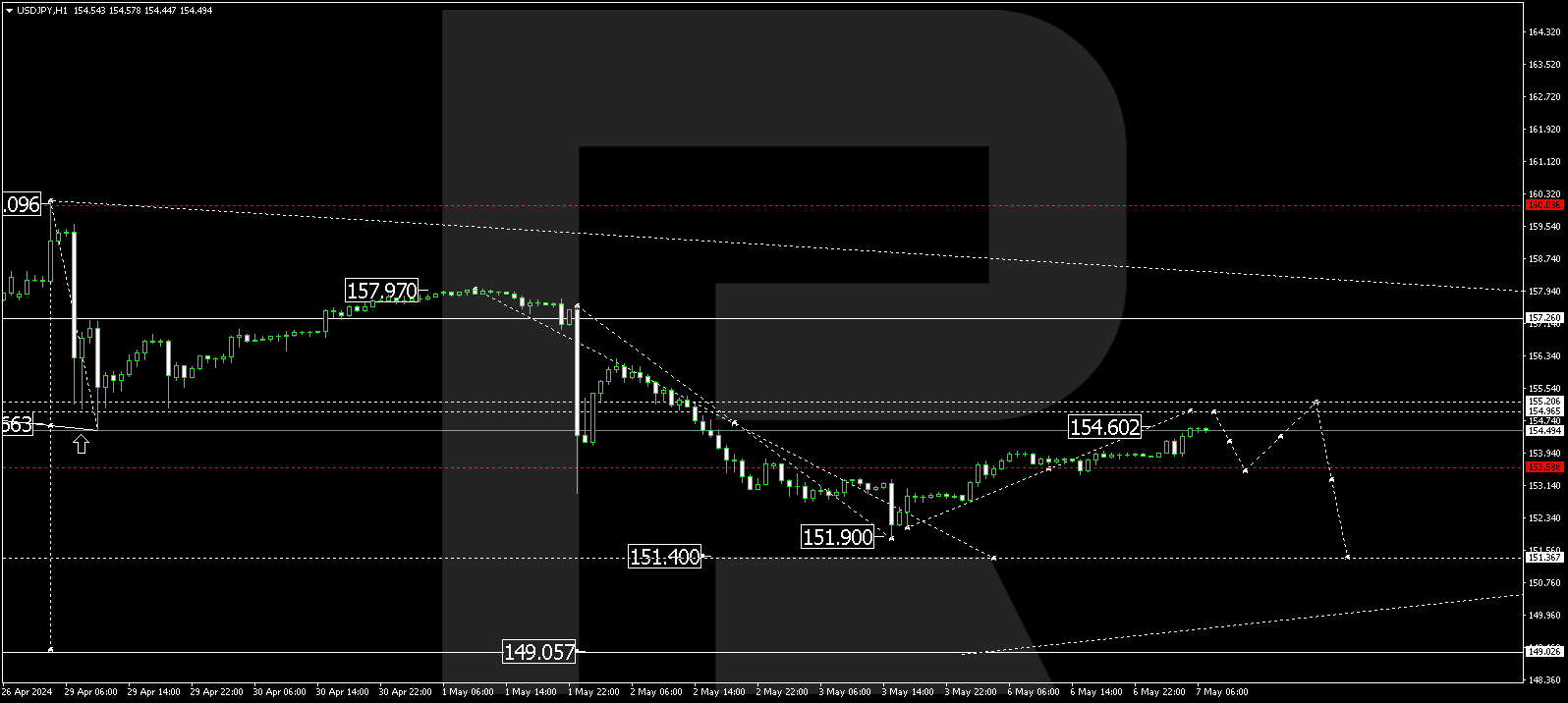

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues to develop a decline wave towards 151.36. After reaching this level, the price could correct to 155.20 (testing from below). Once the correction is complete, a new decline wave could start, aiming for 149.00 representing the first target of the decline wave.

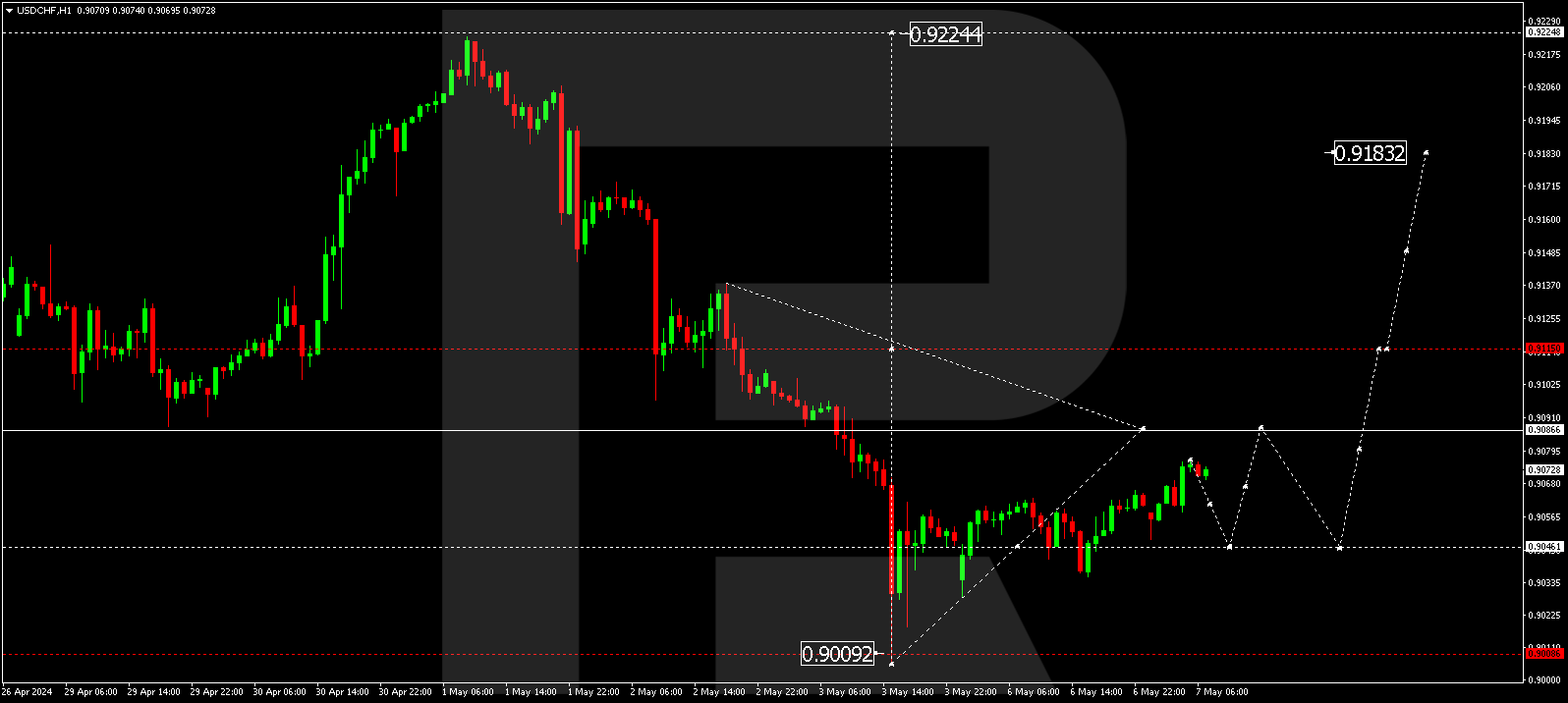

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues to develop a growth wave towards 0.9090. After the price reaches this level, a corrective phase is not ruled out, targeting 0.9050 (testing from above). Next, a new growth wave could start, aiming for 0.9115, with the trend potentially continuing to the local target of 0.9182.

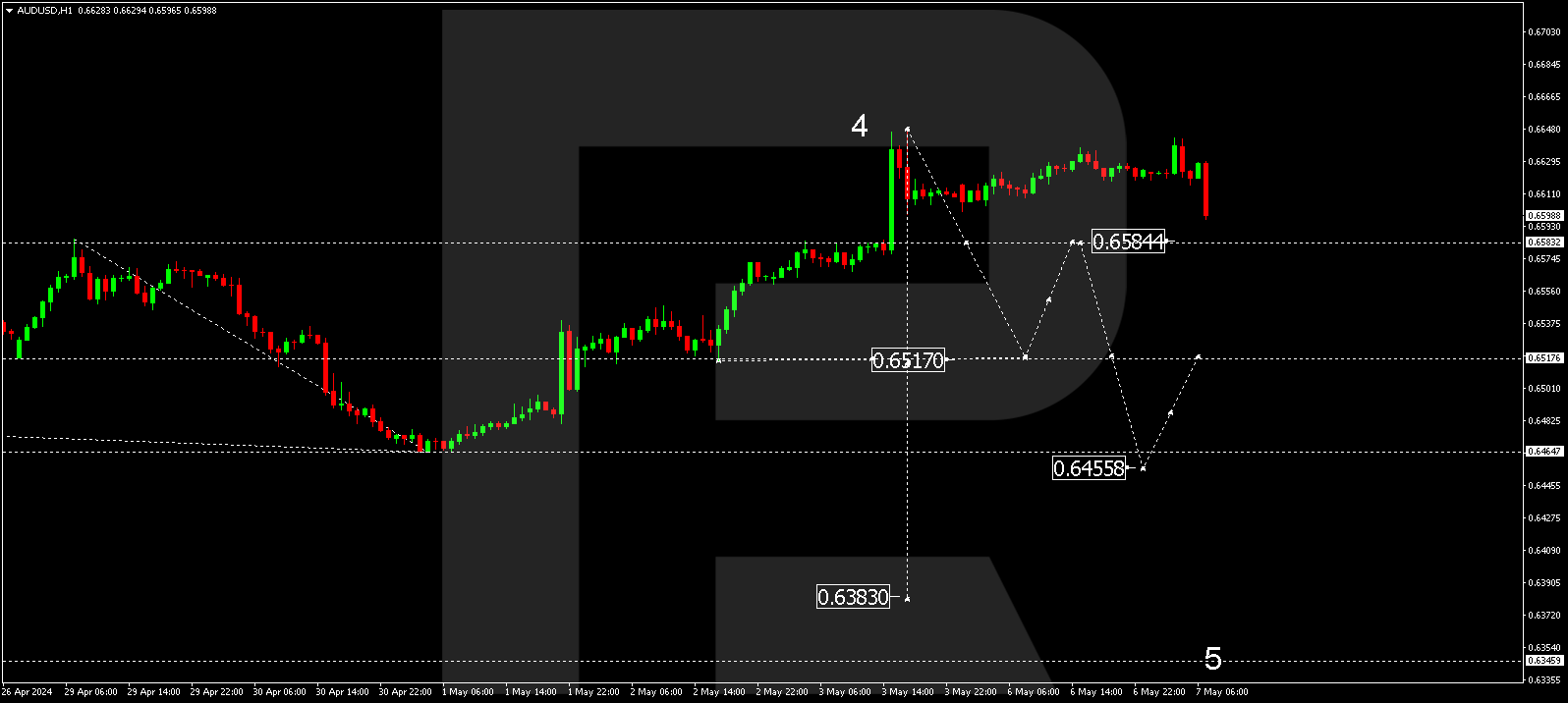

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair is forming a consolidation range below 0.6646. A downward breakout of the range towards the first target of 0.6518 is expected. After the price reaches this level, a corrective phase is not ruled out, targeting 0.6588. Next, the price could decline to 0.6455, from where the trend might expand to 0.6350.

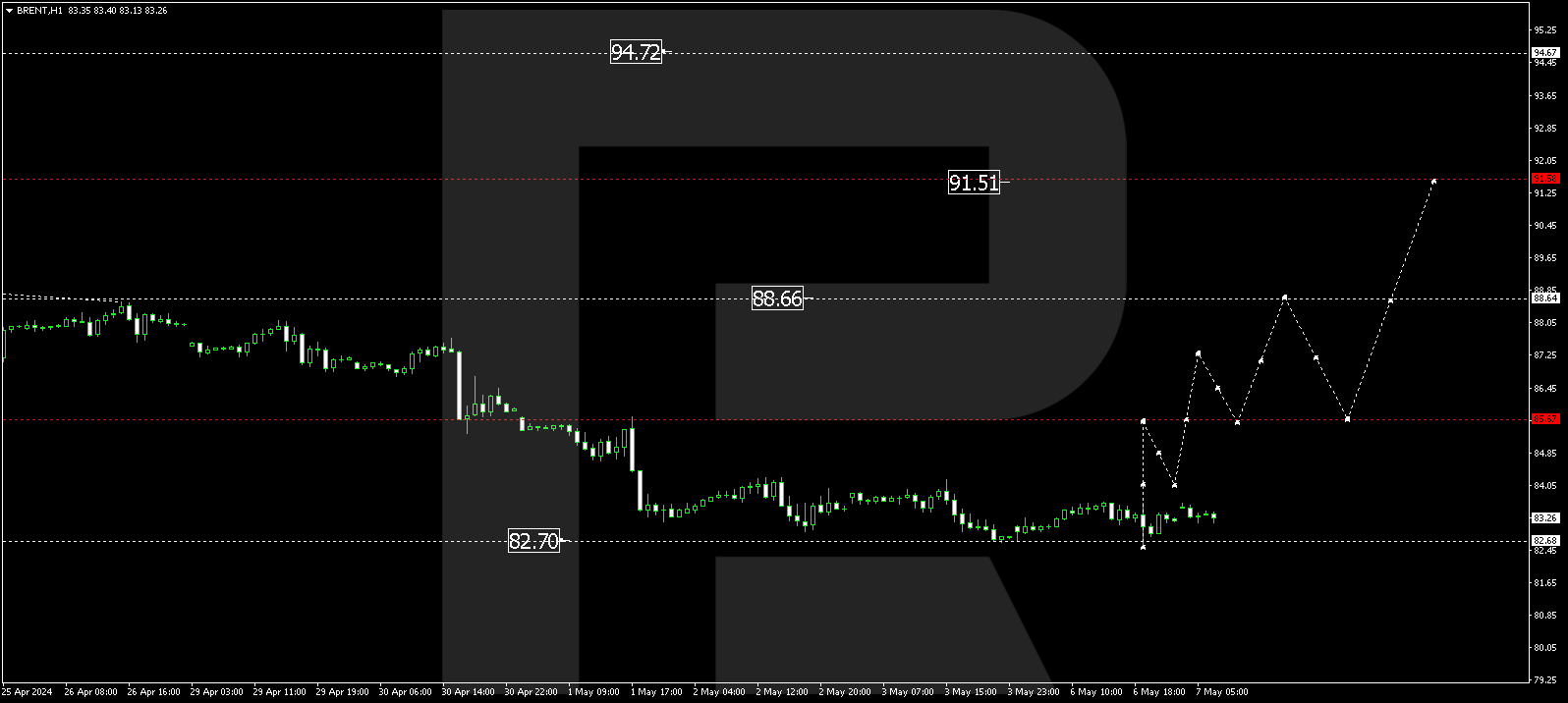

BRENT

Brent has completed a corrective wave, reaching 82.70. Today, the market is forming a consolidation range above this level. An upward breakout is expected, with the growth wave developing towards the first target of 88.64. After the price reaches this level, a corrective wave is not ruled out, aiming for 85.66. Subsequently, a new growth wave could start, targeting 91.60 and potentially continuing to 95.00.

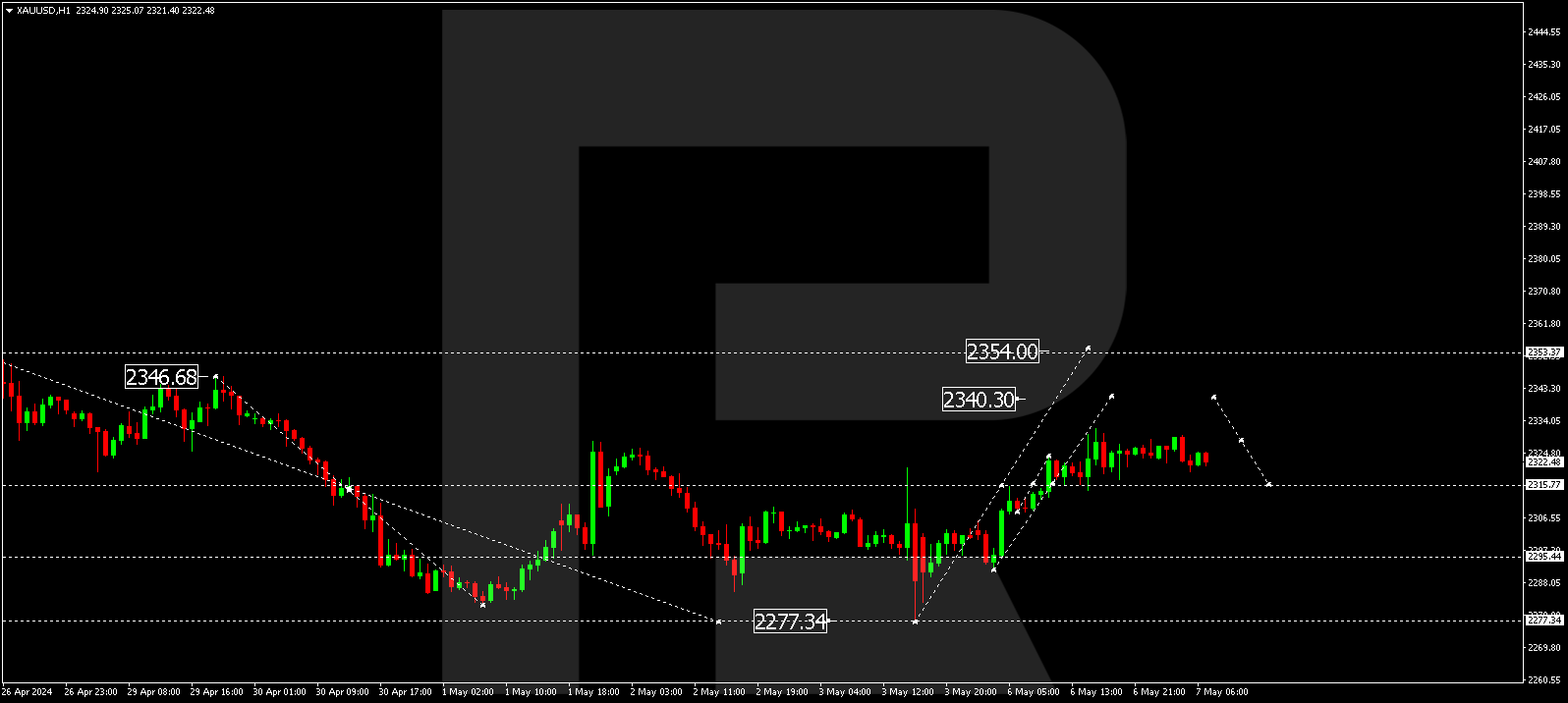

XAUUSD, “Gold vs US Dollar”

Gold has completed a decline wave, reaching 2277.10. The price is expected to correct to 2353.33 today. After reaching this level, the price could decline to 2315.77. Practically, a new consolidation range could form within these levels. With a downward breakout, the decline wave might continue to 2266.40. With an upward breakout, a rise towards 2400.00 is expected.

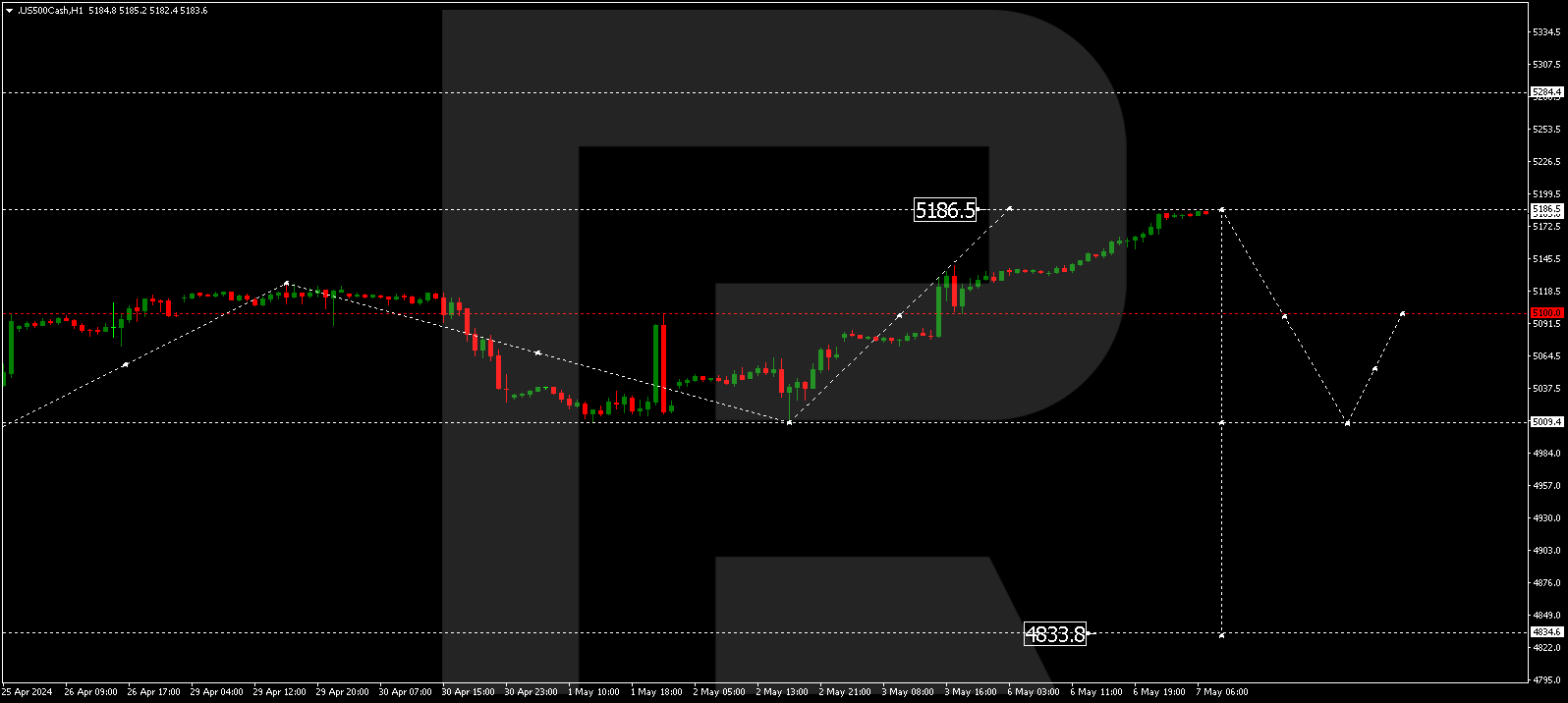

S&P 500

The S&P 500 index continues to develop a correction, aiming for 5186.5. Once the price hits this level, a new decline wave could start, targeting 5000.0 and potentially expanding to 4868.8. A breakout of this level will open the potential for a wave towards the local target of 4590.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.